Insurance Out Of Pocket Max Meaning, Many health plans have limits well below these federally mandated ones. After you spend this amount on deductibles copayments and coinsurance for in network care and services your health plan pays 100 of the costs of covered benefits. The most you have to pay for covered services in a plan year. This means the health insurance company can t force you to spend more than 7 900 if you re an individual or 15 800 if you re part of a family plan. This Insurance Out Of Pocket Max Meaning can save as free with high resolution 4k for your information and reference before execute your plan.

Medicare out of pocket costs are the amount you are responsible to pay after medicare pays its share of your medical benefits. What is an out of pocket maximum. It is also called the out of pocket limit. The highest out of pocket maximum for a health insurance plan in 2020 plans is 8 200 for individual plans and 16 400 for family plans.

If you have health insurance the federal government establishes limits on how much a person or family will pay out of pocket annually.

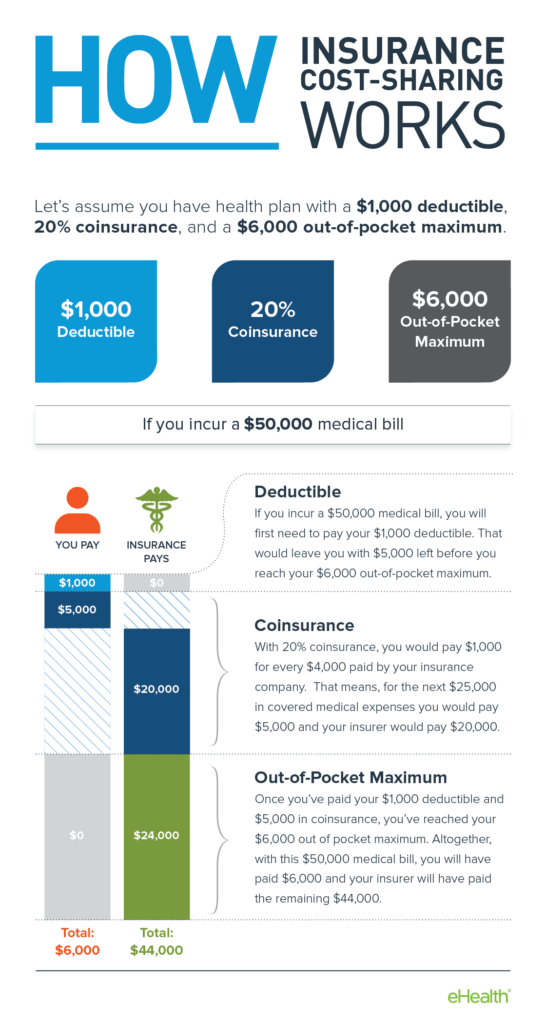

Think of the out of pocket limit as your deductible coinsurance copayments if your plan has them up to a total dollar amount. Insurance Out Of Pocket Max Meaning Once you reach your out of pocket max your plan pays 100 percent of the allowed amount for covered services. This means the health insurance company can t force you to spend more than 7 900 if you re an individual or 15 800 if you re part of a family plan. In medicare part a there is no out of pocket maximum. Your plan s out of pocket maximum is the most you will need to spend on health care expenses. If you have health insurance the federal government establishes limits on how much a person or family will pay out of pocket annually. In 2020 those limits are 8 200 for individuals and 16 400 for families. After you spend this amount on deductibles copayments and coinsurance for in network care and services your health plan pays 100 of the costs of covered benefits. Many health plans have limits well below these federally mandated ones. Out Of Pocket Costs For Health Insurance

How An Out Of Pocket Maximum Works For You, An out of pocket maximum is a cap or limit on the amount of money you have to pay for covered health care services in a plan year. After you spend this amount on deductibles copayments and coinsurance for in network care and services your health plan pays 100 of the costs of covered benefits. If you meet that limit your health plan will pay 100 of all covered health care costs for the rest of the plan year. Some health insurance plans call this an out of pocket limit. Out of pocket maximum mean is the most a health insurance policyholder will pay each year for covered healthcare expenses. These limits help policyholders. What is an out of pocket maximum. The out of pocket limit doesn t include. It is also called the out of pocket limit. The most you have to pay for covered services in a plan year.

In medicare part a there is no out of pocket maximum. Some health insurance plans call this an out of pocket limit. After you spend this amount on deductibles copayments and coinsurance for in network care and services your health plan pays 100 of the costs of covered benefits. What is an out of pocket maximum. If you meet that limit your health plan will pay 100 of all covered health care costs for the rest of the plan year. An out of pocket maximum is a cap or limit on the amount of money you have to pay for covered health care services in a plan year. The most you have to pay for covered services in a plan year. It is also called the out of pocket limit. These limits help policyholders. The out of pocket limit doesn t include. Out of pocket maximum mean is the most a health insurance policyholder will pay each year for covered healthcare expenses.

An out of pocket maximum is a cap or limit on the amount of money you have to pay for covered health care services in a plan year. Out of pocket maximum mean is the most a health insurance policyholder will pay each year for covered healthcare expenses. The out of pocket limit doesn t include. What is an out of pocket maximum. An out of pocket maximum is a cap or limit on the amount of money you have to pay for covered health care services in a plan year. It is also called the out of pocket limit. Some health insurance plans call this an out of pocket limit. The most you have to pay for covered services in a plan year. After you spend this amount on deductibles copayments and coinsurance for in network care and services your health plan pays 100 of the costs of covered benefits. If you meet that limit your health plan will pay 100 of all covered health care costs for the rest of the plan year. These limits help policyholders.